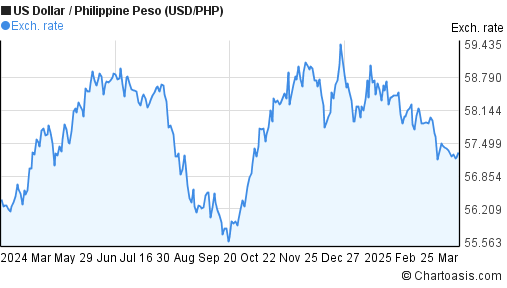

Best exchange rate: 0.0196 USD on 03 Feb.

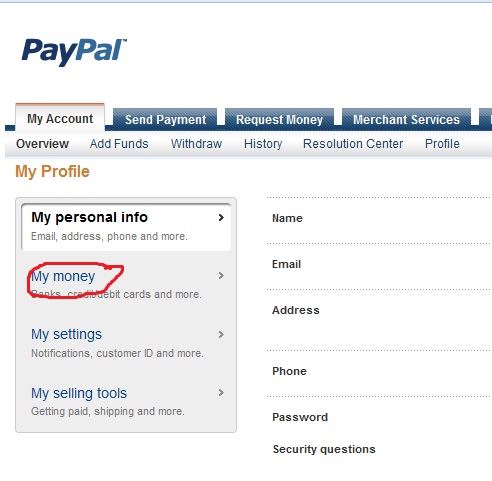

Inflation is running near 1970s levels in the U.S. This is the Philippine Peso (PHP) to US Dollar (USD) exchange rate history data page for the year of 2022, covering 202 days of PHP USD historical data.Bullard: Reflections on the Disinflationary Methods of Poincaré and Thatcher, Slides Inflation Near 1970's Levels: The PHP to USD forecast at the end of the month 1.742, change for October 0.0. Convert To Result Explain 1 PHP: USD: 0.01961 USD: 1 Philippine Peso in US Dollars is 0.01961 for : 100 PHP: USD: 1.9608 USD: 100 Philippine Pesos in US Dollars is 1. Peso to Dollar forecast for October 2022. and the EA if the post-pandemic regime shift is executed well,” Bullard concluded. The PHP to USD forecast at the end of the month 1.742, change for September -2.9. “The Fed and the ECB have considerable credibility compared with their 1970s counterparts, suggesting that a soft landing is feasible in the U.S. The exchange rate of the Philippine Peso in relation. Subsequent literature illustrated how credibility might be earned in models that depart from rational expectations, he said. The cost of 2 Philippine Pesos in United States Dollars today is 0.04 according to the Open Exchange Rates, compared to yesterday, the exchange rate increased by 0.44 (by +0.0001). Nobel laureate and economist Thomas Sargent initiated a literature on costless disinflation (“soft landings”) that emphasized inflation expectations as the key variable, not the Phillips curve, Bullard noted. The disinflation under former Fed Chair Paul Volcker was costly, he added, but it was not credible initially-Volcker had to earn credibility. and the euro area (EA) is near 1970s levels, Bullard said. He spoke before the Money Marketeers of New York University. Louis Fed President Jim Bullard talked about the academic literature related to “credible” versus “incredible” disinflation and how that may apply to current conditions. Bullard: Reflections on the Disinflationary Methods of Poincaré and Thatcher St. Tweet at 6:47pm: FED'S BULLARD: IT APPEARS THAT BOTH THE FED AND THE ECB WILL BE ABLE TO CUT INFLATION IN AN ORDERLY MANNER, ACHIEVING A PRETTY SOFT LANDING.

0 kommentar(er)

0 kommentar(er)